Working capital is a financial metric that shows the difference between current assets and current liabilities.

What is Working Capital?

Working capital is a measure of a company’s operational liquidity and short-term financial health. It represents the difference between a company’s current assets and current liabilities. Essentially, it shows how much money is available to cover day-to-day operations.

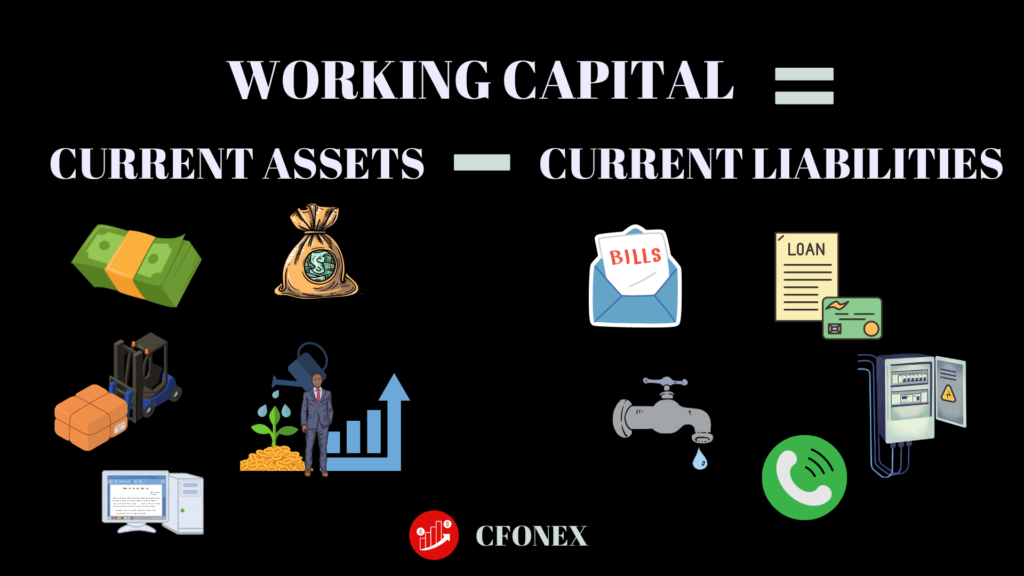

The formula for working capital is:

Working Capital=Current Assets−Current Liabilities

Positive working capital means the company has enough assets to cover its short-term liabilities, which is generally a sign of good financial health. Negative working capital, on the other hand, might indicate potential liquidity issues, where the company might struggle to meet its short-term obligations.

Here’s a deeper look into working capital and its implications:

Components of Working Capital

- Current Assets:

- Cash and Cash Equivalents: Immediate funds available for use.

- Accounts Receivable: Money expected to be received from customers.

- Inventory: Goods available for sale or raw materials used in production.

- Other Short-Term Assets: Prepaid expenses, short-term investments.

- Current Liabilities:

- Accounts Payable: Money owed to suppliers and creditors.

- Short-Term Loans: Loans or borrowings due within a year.

- Accrued Expenses: Expenses that have been incurred but not yet paid (e.g., wages, utilities).

Importance of Working Capital

- Liquidity Management:

- Ensures a company can meet its short-term obligations without having to sell long-term assets or secure additional financing.

- Operational Efficiency:

- Positive working capital indicates that the company can finance its day-to-day operations and invest in growth opportunities.

- Financial Health:

- A consistently positive working capital position is often seen as a sign of financial stability and operational efficiency.

- Risk Management:

- Helps in managing risks related to cash flow shortages and avoiding potential disruptions in operations.

Working Capital Ratios

Several ratios use working capital to assess a company’s financial health:

- Current Ratio:

- Current Ratio=Current Assets/Current Liabilities

- Measures how well a company can cover its short-term liabilities with its short-term assets. A ratio above 1 indicates more assets than liabilities.

- Quick Ratio (Acid-Test Ratio):

- Quick Ratio= (Current Assets−Inventory)/Current Liabilities

- A more stringent measure than the current ratio, excluding inventory, which may not be as liquid.

- Working Capital Ratio:

- Working Capital Ratio=Working Capital/Current Liabilities

- Provides a percentage of working capital relative to current liabilities.

Management Strategies

- Inventory Management:

- Optimize inventory levels to avoid excess or shortages, which can tie up or deplete cash flow.

- Receivables Management:

- Implement efficient credit policies and collection practices to reduce days sales outstanding (DSO).

- Payables Management:

- Negotiate favorable terms with suppliers and manage payment schedules to improve cash flow without damaging supplier relationships.

- Cash Flow Forecasting:

- Regularly forecast cash flows to anticipate periods of cash surplus or shortages and plan accordingly.

Implications of Working Capital Management

- Growth and Expansion:

- Adequate working capital allows companies to invest in new projects, hire more staff, and expand operations.

- Operational Flexibility:

- Companies with strong working capital can adapt more quickly to changes in market conditions or business opportunities.

- Cost of Capital:

- Efficient working capital management can reduce the need for expensive short-term borrowing and improve overall cost of capital.

In summary, effective working capital management is crucial for maintaining financial stability, operational efficiency, and the ability to capitalize on growth opportunities.

Leave a Reply