Chart of accounts (COA) is a list of all the financial accounts in the general ledger of a company.

Chart of Accounts Definition

A chart of accounts (COA) is an index or a list of every account in the general ledger of a company. Accounts are presented by category in the following order:

A company creates its own chart of accounts to fit the nature of its business activities. It is vital to understand the nature of each typical account, as each one represents a unique record for each type of asset, liability, equity, revenue and expense.

A well-organized and structured Chart of Accounts will help guide a company to wade through the maze of financial data in a concise manner. Chart of Accounts is one of the fundamental tools in accounting that helps companies categorize and track financial transactions that keep them organized and monitored accurately.

Chart of Accounts Components

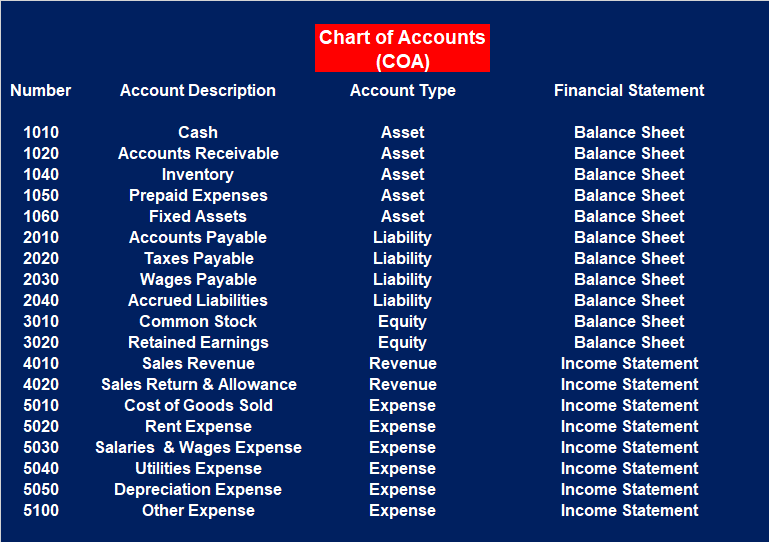

Each account in the chart of account corresponds to the two main financial statements: Balance sheet and income statement (profit and loss). A company’s chart of accounts acts as an internal control measure where each transaction is recorded in the financial system with transparency. Here is the breakdown for the components of Chart of Accounts which include Account number, Account Description, Account Type, and Financial Statement:

Account Number

Account numbers are the unique code assigned to each account type and sub-type. When creating the numbers for the Chart of Accounts make sure to leave space or gap for any future addition. As the company grow, there will be a need to add more accounts to the Chart of Accounts.

Account Description

Create a title or name for each account in the Chart of Accounts. Account names or titles will be the one printed on the balance sheet statements and income statements. For example, account Rent Fees is a revenue account that will show up on the income statement or the profit and loss statement, and account Prepaid Insurance will show up on the balance sheet statement.

Account Type

1- Assets: Assets represents the categories the company owns. Asset accounts include current assets like cash, receivables, inventory as well as no-current assets or fixed accounts and intangible assets. All asset accounts start with the prefix number 1.

2-Liabilities: Liability accounts provide a list of categories for all the debts that the company owes such as current liabilities that include trade payable, interest payable as well as non-current or long-term liabilities such as Bonds and long-term notes. All liability accounts start with the prefix number 2.

3- Equity: Equity accounts represent the owners or shareholders stake in the company such as equity and preferred share capital. All equity accounts start with the prefix number 3.

4- Revenue: Revenue accounts represent the company’s income or profits such as sales revenue, rent fees, interest received, and/or other earnings. All revenue accounts start with the prefix number 4.

5- Expense: Expense accounts represent company’s expenses such as cost of goods, salaries and wages, marketing expense, utilities expense, depreciation expense. All expense accounts start the prefix number.

Financial Statement

For this column, reference the financial statement that is impacted by the accounts. For example, all assets, liability, and equity accounts impact the balance sheet while all revenue and expense accounts impact the income statement or the profit and loss statement.

Chart of Accounts Sample

Here’s a sample of chart of accounts list. As shown, accounts are usually listed in order of their appearance in the financial statements, starting with the balance sheet and continuing with the income statement. Thus, the chart of accounts begins with cash, proceeds through liabilities and equity, and then continues with accounts for revenue and then expenses.

Chart of Accounts Adjustments

Chart of Accounts can be updated or changed anytime there is a need to do so. If a new GL needs to be created to reflect a new business rule in terms of assets, liabilities, equity, expense and/or revenue, then creating this GL makes more business sense.

For example, if a company is starting to offer new service, then a new GL for that service needs to be created in order to reflect that GL correctly on the financial reports and to keep track record of the newly generated revenue item. Same scenario also exists to add new GL expense item.

Leave a Reply