Prepaid expenses are future expenses that are paid in advance in one accounting period and the benefits for the goods or services are expected to be used in future accounting periods.

Prepaid expenses, also known as prepaid assets, are future expenses that have been paid in advance. Examples of prepaid expenses are rent, insurance premiums, supplies, and subscriptions.

Prepaid Expenses Accounting

Prepaid expenses are recorded on the balance sheet as current assets, because they have future economic benefits, and then they are recognized as an expense when the benefits are realized or used. The reason prepaid expenses are included in the balance sheet and not in the income statement is because of GAAP’s (Generally Accepted Accounting Principles) matching principle.

The matching principle of accounting requires accrual accounting which states that revenue and expenses be reported in the same period as incurred no matter when cash or money exchanges hands.

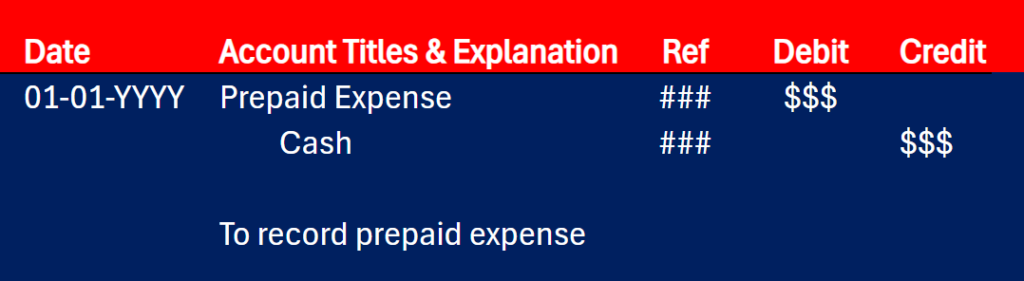

The initial entry of recording prepaid expenses is to debit the prepaid expense account and credit the account used to pay for the expense.

And at the end of each accounting period, the controller will make an adjusting entry for prepaid expenses that results in an increase (debit) to an expense account and a decrease (credit) to an asset account.

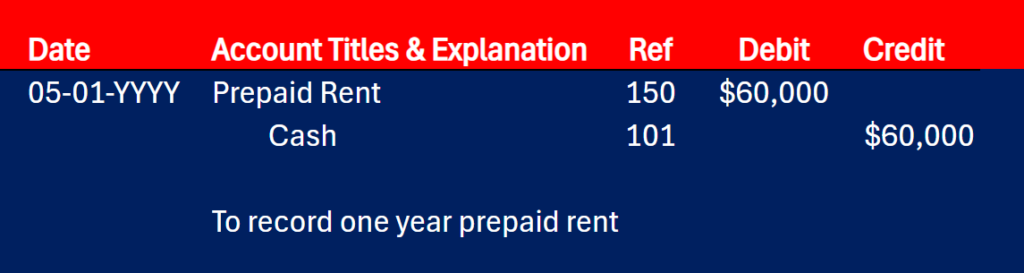

Prepaid Rent Journal Entry Example

Sunshine facility signed a one-year lease agreement on May 01, YYYY to open a new assisted living facility. The lease agreement requires the facility to pay the 12-month rent in advance in order to get the bargain deal. The rent amount for the year is $60,000.

The initial journal entry for Sunshine Facility would be as follows:

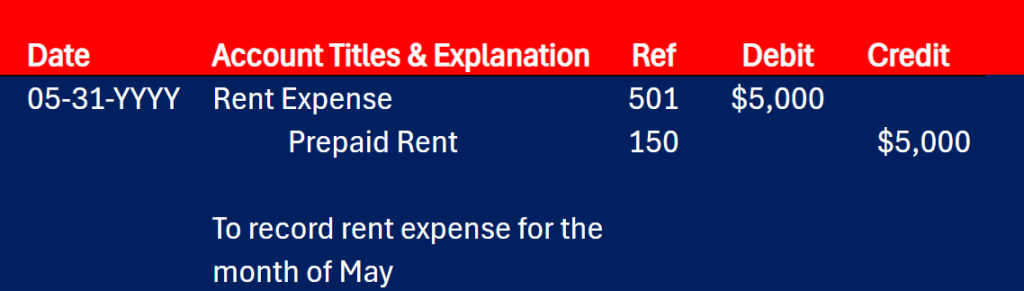

At the end of the month of May, Sunshine Facility needs to adjust it prepaid rent account to reflect the payment of rent for the month of May. The rent expense for the month of May is $5,000 ($60,000/12 month = $5,000). So, the adjusting journal entry at the end of May will be as follows:

Leave a Reply