Journal entry is the first step in the accounting cycle and is the foundation of the double-entry accounting system that shows the effects of debits and credits transactions in the company’s books in a chronological order.

Definition, Format, How To, Types, Examples

Journal Entry Definition

A journal entry is an accounting method that is used to record a business transaction in the accounting books of a business.

Double-entry accounting system requires each business transaction to be recorded in at least two accounts. Each transaction impact at least two accounts, one debit and one credit. The total amount of debit/s should always equal total amount of credit/s.

With computerized accounting software, most of the journal entries generated may not be visible but they are being generated in the back end.

Journal Entry Format

A journal entry requires the following elements:

- Date of transaction

- Account numbers

- Reference number

- Description

- Debit and credit equal amounts

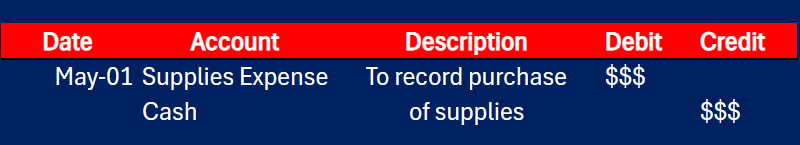

Here is an example of a journal entry: Purchase supplies for $1000 and paid cash on May 01

Journal Entry Types

There are 6 kinds of journal entries:

- Opening Journal Entries: Are made at the beginning of the financial year and they carry forward the closing balances of the previous year.

- Transfer Journal Entries: Are used to transfer or allocate expenses or revenue from one account to another; are used to transfer cash or funds between accounts.

- Closing Journal Entries: A closing entry is made at the end of an accounting period to transfer balances from a temporary account to a permanent account.

- Adjusting Journal Entries: Made at the end of the accounting period such as month-end for example. Adjusting journal entry are made to be in compliance with accounting frameworks such as Generally Accepted Accounting Principles (GAAP). One of GAAP’s principles is the matching principle that require expenses to be reported in the same period alongside revenue earned. Examples of adjusting journal entries are expense accrual, revenue accrual, expense deferral, and deferred revenue.

- Compound Journal Entries: When there are more than two lines of entries in a journal entry. In some journal entries, there are one or more debit entries and one or more credit entries. An example will be the payroll journal entry. In the payroll journal entry, for example, you credit operating cash account (-) and you debit one or more expense accounts such as payroll, taxes (FICA and SUTA), worker’s comp. insurance, and fees.

- Reversing Journal Entries: They are usually made at the beginning of an accounting period. Reversing journal entries are made to reverse an adjusting entry made at the end of the previous accounting period. Reversing journal entries are used also to make a correction to regular journal entries there were made in error.

Journal Entry Process

The following are the steps of making a journal entry:

- Identify transactions

- Analyze transactions

- Journalize transactions

Journal Entry Examples

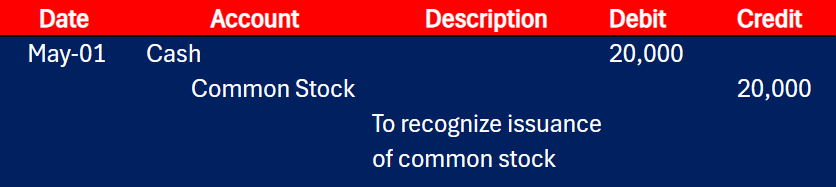

On May 01, XYZ Company issues $20,000 shares of common stock for cash.

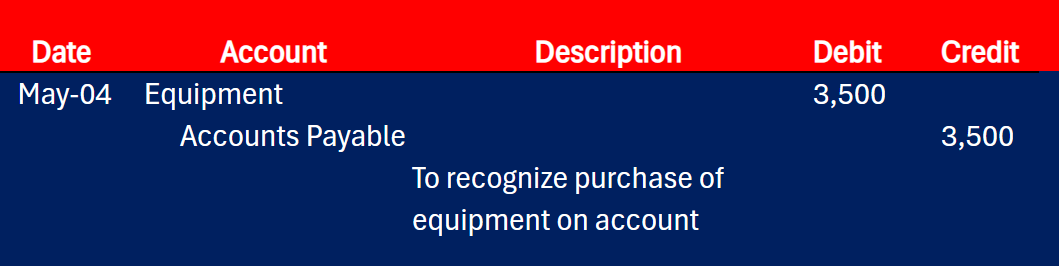

On May 4, XYZ Company purchases equipment on account for $3,500 payable in 30 days.

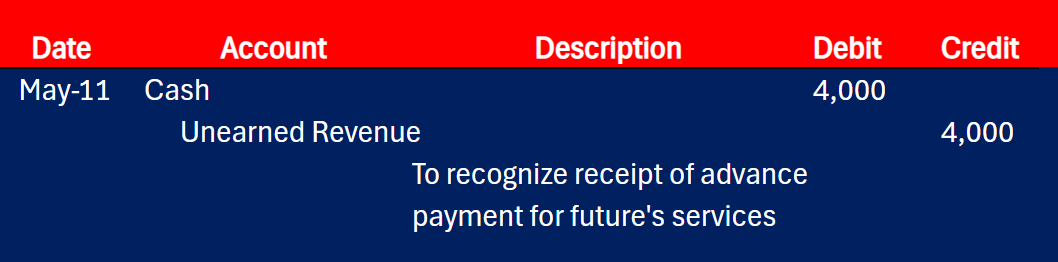

On May 11, XYZ Company received $4,000 cash in advance from a client for services not yet rendered.

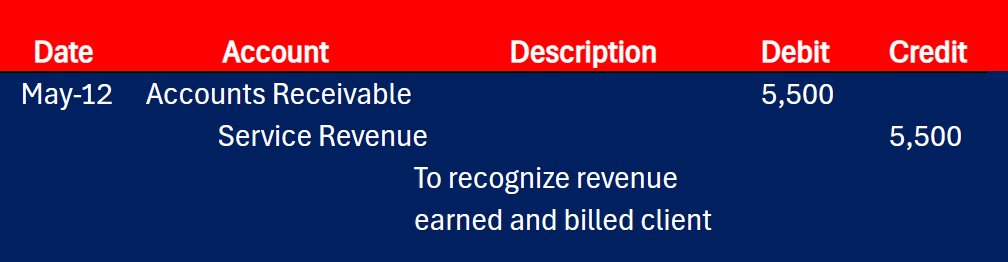

On May 12, XYZ Company provides $5,500 in services to a client paying on account.

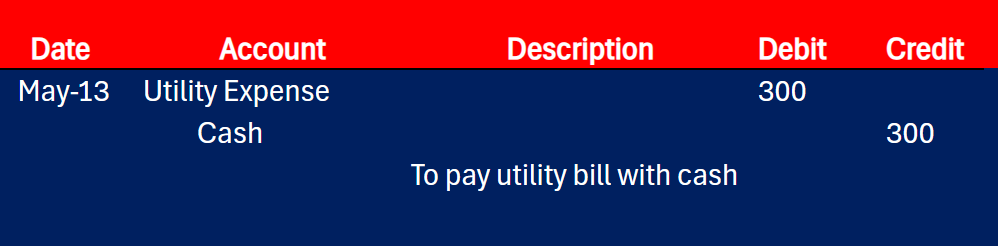

On May 13, XYZ Company pays a $300 utility bill with cash.

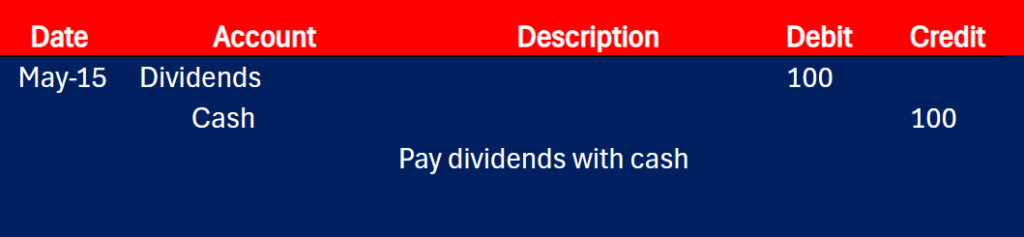

On May 15, XYS Company distributed $100 cash in dividends to stockholders.

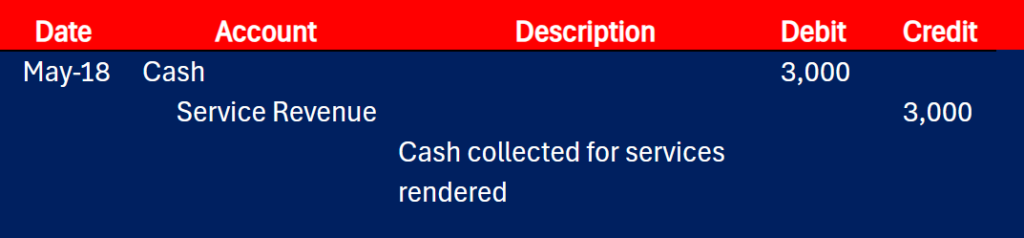

On May 18, XYZ Company receives $3,000 cash from a customer for services rendered.

Leave a Reply