Depreciation, a non-cash business expense, is the process of reducing the value of a physical or tangible asset over time due to wear and tear.

Depreciation is the process of deducting or writing-off the total cost of a physical asset over its lifespan. Due to wear and tear, the asset decreases in value over time.

This reduction of an asset happens because of GAAP matching principle that states that a company should match related revenues and expenses in the same accounting period. It is basically done in order to link the costs of an asset or revenue to its benefits.

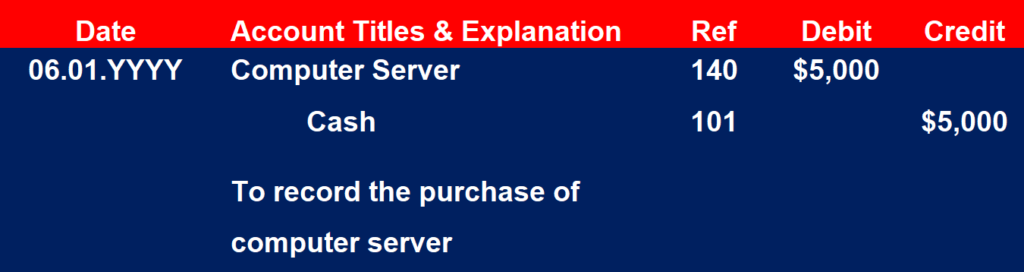

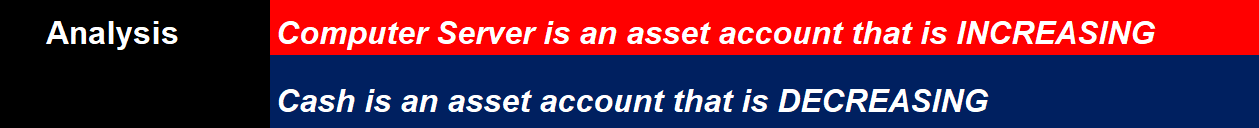

When a company buys a physical asset, it records the transaction as a debit to increase an asset account on the balance sheet and a credit to reduce cash, which is also on the balance sheet. Neither journal entry affects the income statement, where revenues and expenses reported.

Depreciation’s Methods

Here are four common methods of calculating annual depreciation expense:

1- Straight-Line depreciation

2- Units of production depreciation

3- Double declining balance depreciation

4- Sum of the years’ digits depreciation

Depreciation’s Calculation

Three elements are required in order to calculate the depreciation expense:

1- Asset cost: The purchase price of the asset

2- Useful life: The number of years the asset is expected to last

3- Salvage value: The value of the asset at the end of its useful life

Depreciation Journal Entry Example

A facility purchased a new computer server in the amount of $5,000 on June 01 with a salvage value of $1,000 and useful life of 5 years. Here is the breakdown:

Asset cost: $5,000

Useful life: 5 years

Salvage value: $1,000

The initial journal entry to record the purchase is debit the asset account, Lift Equipment, and credit the cash account for the purchase for the amount of $5,000.

Fixed assets are first recorded as assets that are gradually written-off or expensed over time. That is the reason why the journal entry is to debit the computer server account which is an asset account and not computer expense account. This process of gradually expensing off the cost of a fixed asset as it is used up over its life span is called depreciation.

Using the straight-line, the annual depreciation amount is calculated as follows:

Straight-Line Method: (Cost – Residual Value) /useful life in years

= $5,000 – $1,000/5= $800 per year is the depreciation

Since the facility closes the financial books on a monthly basis, an adjusted journal entry is required to be entered at the end of June.

The $800 depreciation expense is the annual expense, so it needs to be divided by 12 months to reflect the correct expense for the month of June.

Leave a Reply