Accounts receivable turnover ratio is an efficiency ratio that measures how many times a company can turn its accounts receivable into cash during a period.

Accounts Receivable Turnover Ratio Explained

Accounts receivable turnover ratio is a financial metric that measures how efficiently a company is handling its collections of outstanding invoices (money) owed by customers.

A higher accounts receivable turnover ratio indicates that the company is promptly and effectively collecting payments from its customers and vice versa.

The accounts receivable turnover ratio shows how a company is managing the credits it extends to customers as well as collection. A low turnover ratio indicates poor receivable management and low cash flow.

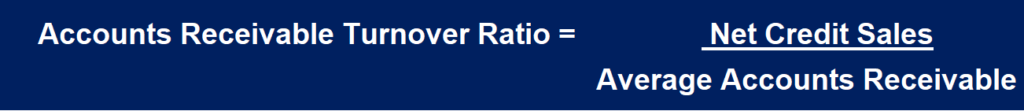

Accounts Receivable Turnover Ratio Formula

The accounts receivable turnover ratio can be calculated by dividing net credit sales by the average accounts receivable for the period.

The components of the Accounts Receivable Turnover Ratio are:

Net Sales: Are sales made on credit during a specific period less any adjustments for returns or allowances.

Sales Returns: products returned by a customer due to being defective or damaged.

Sales Allowances: The reduction of the price of the product due to a problem with the sales transaction (not related to the product itself)

Average Accounts Receivable: Add the number of accounts receivable at the beginning of the period to the number of accounts receivable at the end of the period, and then divide the total by two to find the average.

Accounts Receivable Turnover Ration Example

The CFO of ABC Medical Supplier wants to calculate the Accounts Receivable Turnover Ratio based on the following financial data for the year to measure how effective the company is handling its credit collections from customers as well as its cash flow management:

- Net Credit Sales: $300,000

- Beginning Accounts Receivable: On Jan. 1, the beginning accounts receivable balance is $30,000

- Ending Accounts Receivable: On Dec. 31, the ending accounts receivable balance is $20,000

Based on the Accounts Receivable Turnover Ratio, The CFO can calculate the receivables formula in the following way:

Accounts Receivable Turnover Ratio = (Net credit sales) / (Average accounts receivable)

Where Average Accounts Receivable is ($30,000 + $20,000) / 2=$25,000

Accounts Receivable Turnover Ratio = $300,000 / $25,000 = 12

Based on the analysis, the CFO determined that the company collected its accounts receivables 12 times during the year. So basically, the company converted its receivables to cash 12 times during the year.

The CFO, also, wants to know the average number of days it takes the customers to pay their invoices. To answer the question, the CFO needs to know the average collection period.

To figure out this question, the CFO divide the number of days in the company’s accounting cycle by the receivable turnover ratio.

Average Collection Period = 365/12=30.41 days

Based on the A/R Turnover analysis, it takes the average customer approximately 30 days to pay their debt to the company.

Leave a Reply