Accounts receivable (AR) in accounting refers to the sales of goods or services on credit and they represent future cash payment.

What is Accounts Receivable (AR)?

Accounts receivable (AR) is the money your customers owe you for goods or services that have been delivered or rendered but not yet paid for.

Accounts receivable allow customers to pay for goods or services at a later date and not immediately during the ordinary course of the business.

The process of allowing the sale of goods and services to customers where the payment is set for a later date is called selling on credit.

Accounts receivable is also known as:

- Trade receivables

- Bill receviable

- Debtor

- Trade debtors

Benefits of Using Accounts Receivable

Accounts receivable is crucial for business success as selling on credit encourages more sales. Here are some of the following benefits for using accounts receivable:

- Increase revenue

- Improve cash flow

- Improve CRM (Customer Relationship Management)

Accounts Receivable Accounting

In a bookkeeping or accounting system, Accounts Receivable are recorded on the balance sheet as an asset of the company issuing the goods or services when a sale on credit occurs. Once payments are made at a later date by customers, accounts receivable will be reduced accordingly.

When goods or services are sold on credit to customers, a company will normally credit the sales account and debit accounts receivable account. And when customers pay the invoices at a later date, a company will debit the cash account and credit the accounts receivable by the same amount.

Accounts Receivable Journal Entry

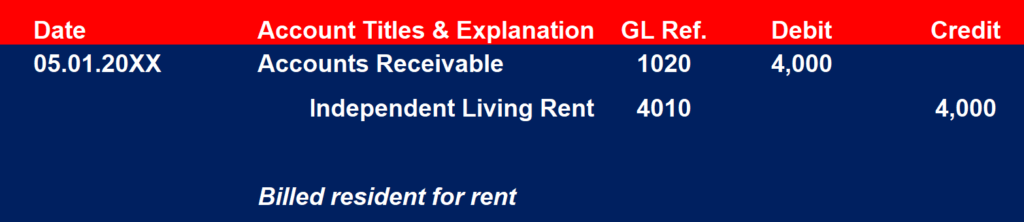

For example, XYZ Facility on May first billed a resident for $4,000 in rent for an independent living room for the month of May, and records the following entry:

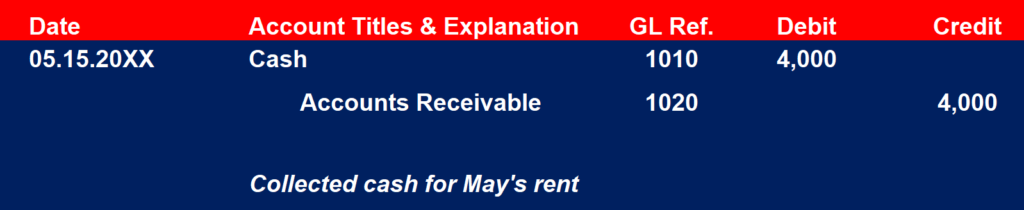

On May 15, the resident pays the bill for $4,000, and XYZ Facility records the following entry:

Risks of Accounts Receivable

Whenever a company sells goods or services to customers on credit, there are always business risks involved. Some of the risks are:

- Some customers will be unable to pay their bills

- Since there is no cash received when selling on credit, cash flow deficiency may exist

Leave a Reply