Accrued revenue refers to revenue that a company has earned by providing goods or services but has not yet billed or received payment for.

How to Record Journal Entry for Accrued Revenue?

Accrued revenue refers to revenue that a company has earned by providing goods or services but has not yet billed or received payment for. It is recorded as an asset on the balance sheet until the payment is received. The concept is part of accrual accounting, which recognizes revenues and expenses when they are incurred, rather than when cash transactions occur.

Recording Accrued Revenue

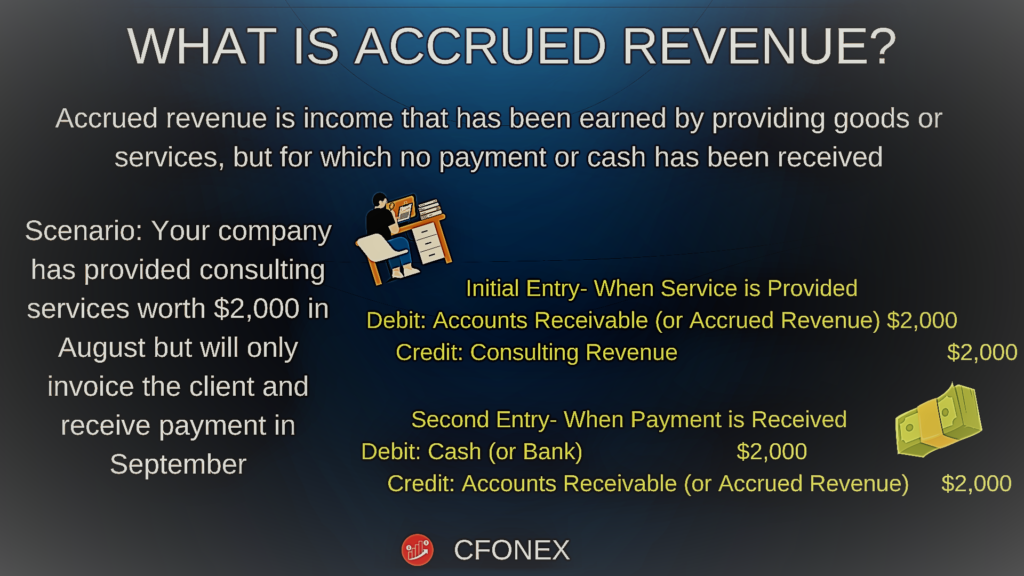

Scenario: Your company has provided consulting services worth $2,000 in August but will only invoice the client and receive payment in September.

Journal Entry for Accrued Revenue

- Debit Accounts Receivable (or Accrued Revenue): This recognizes the amount you are entitled to receive, even though you haven’t billed the customer yet.

- Credit Revenue Account: This records the revenue earned for the services provided.

Detailed Journal Entry:

For Accrued Revenue:

- Debit Accounts Receivable (or Accrued Revenue): $2,000

- Explanation: This entry reflects the amount you expect to receive in the future. If you use an “Accrued Revenue” account instead of Accounts Receivable, it still indicates that revenue has been earned but not yet invoiced.

- Credit Revenue (e.g., Consulting Revenue): $2,000

- Explanation: This entry records the revenue that has been earned. It reflects that the company has fulfilled its part of the contract and has earned revenue even though it hasn’t been invoiced yet.

Complete Journal Entry:

Debit: Accounts Receivable (or Accrued Revenue) $2,000

Credit: Consulting Revenue $2,000

When Payment is Received

Scenario: In September, you issue the invoice and receive the payment of $2,000.

Journal Entry for Billing and Receiving Payment:

- Debit Cash (or Bank): This reflects the actual receipt of cash.

- Credit Accounts Receivable (or Accrued Revenue): This clears the receivable recorded previously.

Detailed Journal Entry:

For Billing and Payment:

- Debit Cash (or Bank): $2,000

- Explanation: This entry records the inflow of cash from the customer.

- Credit Accounts Receivable (or Accrued Revenue): $2,000

- Explanation: This entry clears the receivable previously recorded, as the amount has now been collected.

Complete Journal Entry:

Debit: Cash (or Bank) $2,000

Accounts Receivable (or Accrued Revenue) $2,000

Summary of Accrued Revenue Entries

- At the Time of Earning Revenue (before invoicing):

- Debit: Accounts Receivable (or Accrued Revenue)

- Credit: Revenue Account

- When Invoicing and Receiving Payment:

- Debit: Cash (or Bank)

- Credit: Accounts Receivable (or Accrued Revenue)

Additional Considerations

- Matching Principle: Accrued revenue ensures that revenue is recognized in the period it is earned, aligning with the matching principle of accounting, which states that expenses should be matched with related revenues.

- Financial Statements: Accrued revenue is reported on the balance sheet as an asset and on the income statement as revenue, reflecting the earnings for the period even if the cash has not yet been received.

- Reconciliation: Regularly reconcile accrued revenue accounts to ensure that all earned revenues are recorded and billed appropriately.

These entries help ensure accurate financial reporting and compliance with accounting standards by recognizing revenue when earned, not just when cash is received.

Leave a Reply