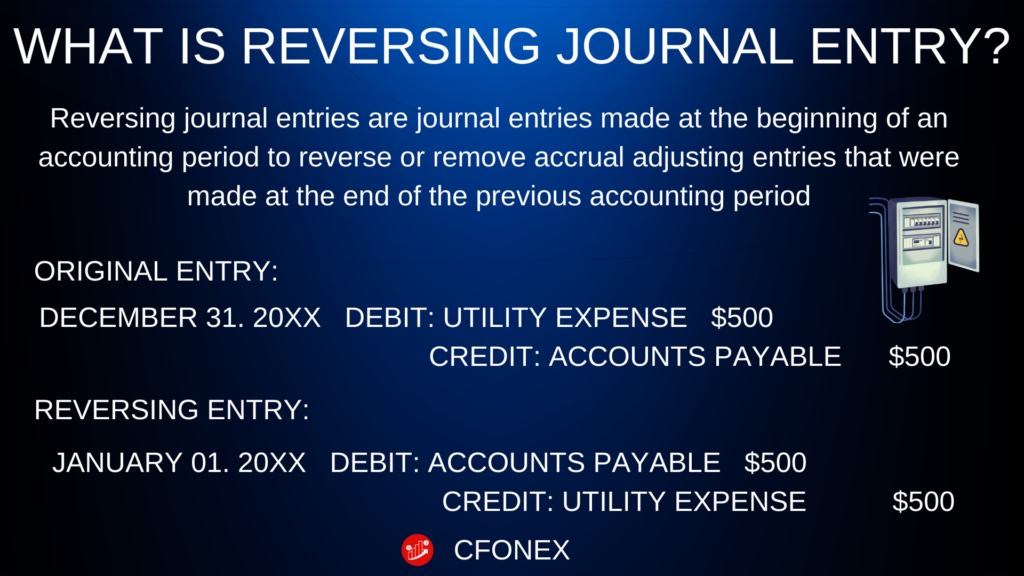

Reversing journal entries are journal entries made at the beginning of an accounting period to reverse or remove accrual adjusting entries that were made at the end of the previous accounting period.

What is Reversing Journal Entry?

A reversing journal entry is an accounting adjustment made to cancel out or correct an earlier journal entry. It’s typically used to reverse the effects of a previous entry, often to correct errors or to simplify accounting for recurring transactions.

How Reverse Journal Entries Work

- Purpose: Reversing journal entries are mainly used for correcting mistakes or adjustments in accounting periods. They help ensure that the financial statements reflect accurate and up-to-date information.

- Mechanics: To reverse a journal entry, you create a new entry that is the exact opposite of the original one. For example, if the original entry recorded a $1,000 expense, the reverse entry would credit (decrease) the expense account and debit (increase) the appropriate account.

- Timing: Reversing journal entries are often used at the beginning of an accounting period to correct entries from the previous period. They are also used in the case of temporary accruals and deferrals that need to be reversed in the subsequent period.

Example Scenario

Let’s say a company recorded an expense of $500 for utilities at the end of December but later realized that the expense was actually for January.

- Original Entry (December):

- Debit: Utilities Expense $500

- Credit: Accounts Payable $500

- Reverse Journal Entry (January):

- Debit: Accounts Payable $500

- Credit: Utilities Expense $500

This reverse entry cancels out the impact of the original entry in the December books and records the correct expense in January.

Common Uses

- Error Correction: To fix mistakes made in the original journal entries. For example, if an expense was recorded in the wrong account, a reverse entry can correct the mistake.

- Accruals and Deferrals: To reverse temporary accruals and deferrals. For example, if you accrue an expense at the end of a fiscal year and then record the actual expense in the new fiscal year, you would reverse the accrual entry at the beginning of the new period.

- Simplifying Accounting: To simplify the accounting process for certain recurring transactions. For example, reversing accruals can help in accurately reporting expenses in the correct period.

Benefits

- Accuracy: Ensures that financial statements reflect accurate information after corrections.

- Clarity: Helps maintain clarity and consistency in accounting records.

- Ease of Reconciliation: Simplifies the process of reconciling accounts and ensures that errors are corrected promptly.

Drawbacks

- Potential for Confusion: If not properly documented, reverse entries can create confusion about the nature of the transactions.

- Requires Monitoring: Need to be carefully monitored to ensure that they are properly documented and justified.

In summary, a reversing journal entry is a useful tool for correcting or adjusting previous entries, ensuring that financial records are accurate and up-to-date.

Leave a Reply