Retained earnings are the profits a company has earned since it began operations minus any dividends distributed over that time.

Retained earnings are the money that a company keeps after paying out dividends to shareholders. The word “retained” means that the company did not pay some earnings to investors and instead the earnings rem by the company.

Retained earnings represent the residual income or profit that is not distributed as dividends to the shareholders but is reinvested in the business. Whenever a company has a net income, the retained earnings account will increase, while a net loss will decrease the amount of retained earnings.

Retained earnings are usually used to pay additional dividends, buy assets or resources such as inventory or equipment as part of business investment, or invest in a new product or service.

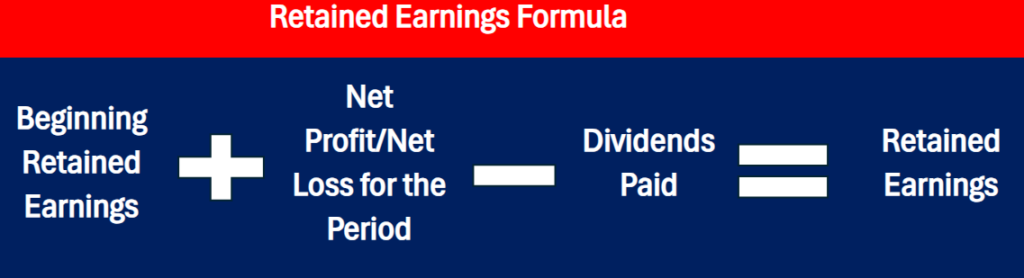

Retained Earnings Formula

The basic formula to calculate retained earnings is as follows:

Beginning retained earnings: Retained earnings ending or closing balance from the previous accounting period will be the beginning period retained earnings balance. If a company closes it books on a monthly basis, then the ending balance from prior month retained earnings on the balance sheet will be the beginning balance for this reported period.

Net Profit/Net Loss (Net Income/Net Loss): The net profit or net loss amount during the current period such as a month or a year is used in the calculation of retained earnings. A net profit or income will lead to an increase in net income, while a net loss will lead to a decrease in retained earnings.

Dividends Paid (both Cash Dividends and Stocks Dividends): Dividends refer to the distribution of profits (either in cash/money or stocks) during an accounting period from the company to its shareholders. Dividends paid out need to be subtracted from retained earnings. If the company does not pay dividends, then a zero (0) will be substituted for this portion of the retained earning formula.

Retained Earnings Example

Richey Resindential Care is planning to hire new Regional Manager and wants to know how much money it has on hand to invest:

The following information is needed for Richey Residential Care to make its decision:

- Beginning retained earnings on January 1, YYYY: $350,000

- Net income for the year ended December 31, YYYY: $125,000

- Dividend paid to shareholders: $55,000

The retained earnings formula is calculated as follows:

$350,000 + $125,000-$55,000 = $420,000

Richey Residential Care has $420,000 in retained earnings to date. This amount of money can be used to cover the new Regional Manager position.

Leave a Reply