Definition, Importance, Components, Examples

What Is Income Statement?

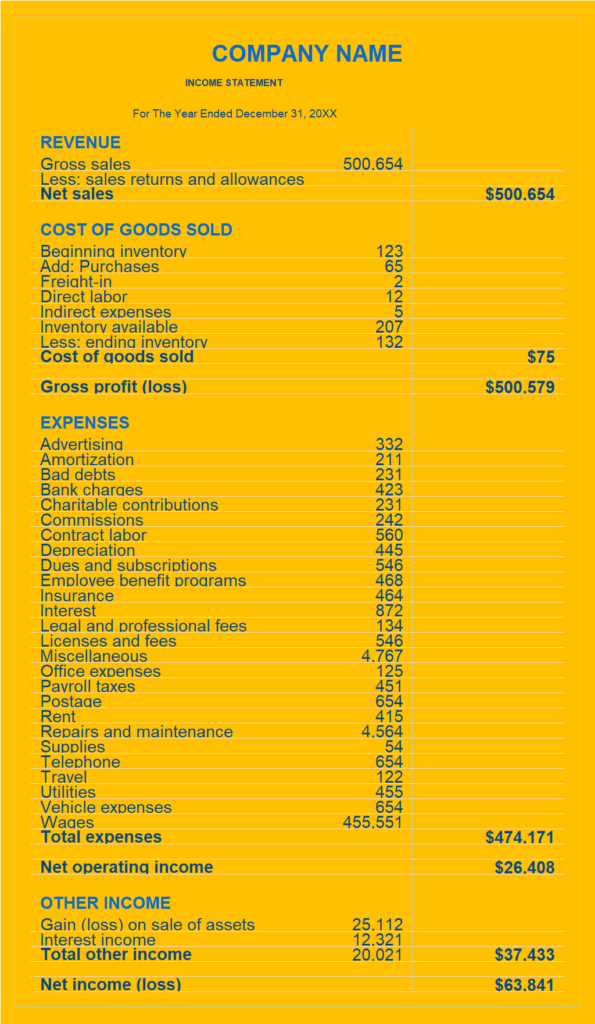

An income statement is a financial report that shows how profitable a company is over a period of time. The income statement, basically, shows the company’s Revenue minus Expenses over a specific accounting period such as a month, a quarter, or a year.

Income statements are also known as:

- Net income statements

- Statements of income

- Statements of earnings

- Statements of operation

- Profit and loss statements or simply P&Ls.

Income Statement Importance

The Income statement is one of the three most important financial statements used for reporting a company’s financial performance, along with the balance sheet and cash flow statement. Income statement is an important document as it demonstrates whether a business is profitable or not.

An income statement helps business owners and managers to evaluate the financial health of their business. Investor and shareholders, lenders and creditors rely on income statement to assess the profitability, risk level, and potential return on investment.

Income Statement Components

Income statement reports profit and loss during a specific period such as a month, quarter, or year. Income statement is comprised of two main parts: Revenue & Expenses.

The main components that can be found on the Income statement are:

- Revenue (or Sales)

- Cost of Goods Sold (COGS)

- Gross Profit

- Selling, General & Administrative Expenses

- EBITDA (Earnings before Interest, Tax, Depreciation, and Amortization)

- Depreciation & Amortization Expense

- Operating Income

- Interest Expense

- Income Tax

- Net Income

Income Statement Example

Conclusion

An income statement also known as the profit and loss statement, or P&L is a report that tracks the flow of money into and out of a business during a given period of time and describes how profitable a business is.

Leave a Reply