In accounting and bookkeeping, debits (called DR) are written on the left side of an accounting journal entry and credits (called CR) are written on the right side of an accounting journal entry.

Definition, Examples

Debits and Credits Definition in Accounting

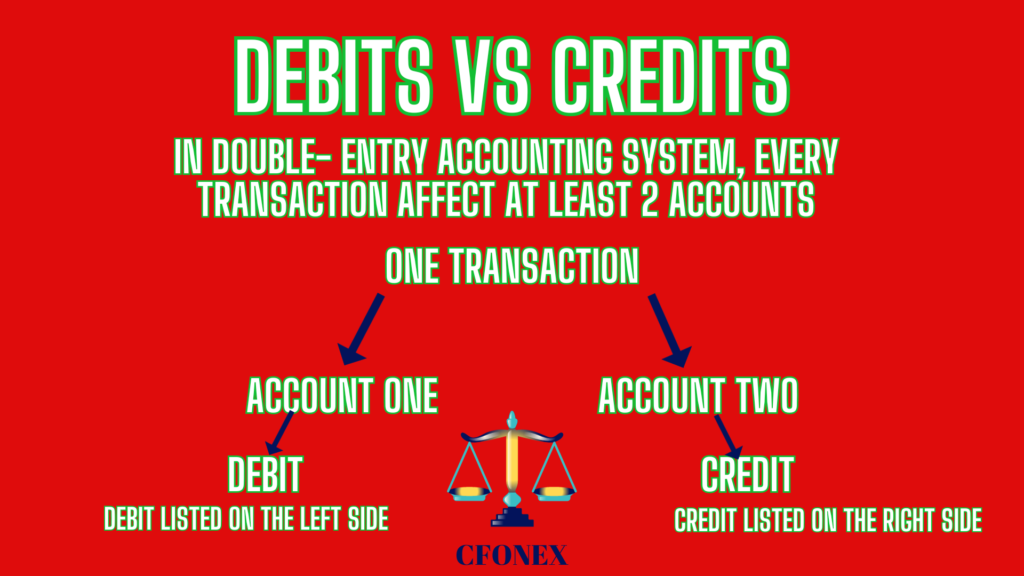

Debits and credits form the basis of the double-entry accounting system. Each financial transaction in a double-entry accounting system must be recorded with at least one debit and one credit, and the total amount of the debits must equal the total amount of the credits.

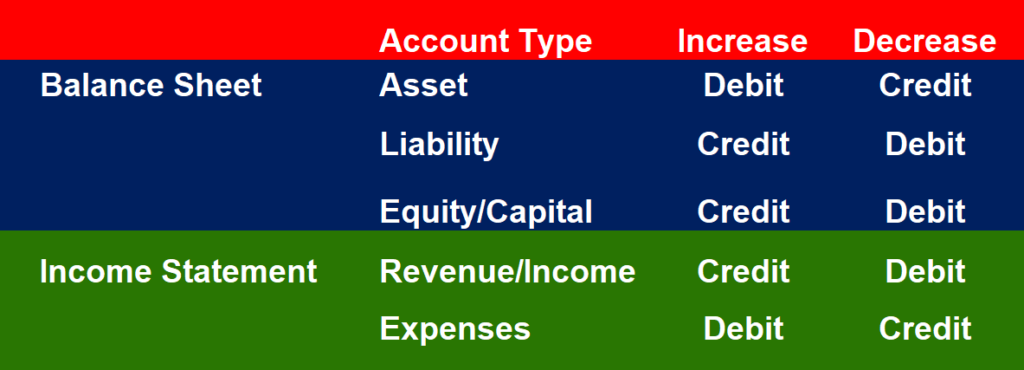

A debit is an accounting entry that either increases an asset or expense account or decreases a liability or equity account.

A credit, on the other hand, is an accounting entry that either increases a liability or equity account or decreases an asset or expense account.

Debits and Credits Origin

Debits and credits are based on the Latin terms “Debere” and “Credre” and they were first used by Luca Pacioli, a mathematician from Italy. Luca Pacioli , known as the father of accounting, published a book that explained the bookkeeping system, a system used by the merchants in Venice during the period of Italian Renaissance.

Debit, which is Debere in Latin, and it means “to owe” and Credit, which is Credre in Latin, and it means “to entrust”. Dr. and Cr., which are both sometimes used as short for debit and credit, are the abbreviation in Latin.

Debits and Credits Rules & Account Types

Debits and credits are the cornerstone of the double-entry bookkeeping system. This system ensures that the accounting equation is always in balance: Assets = Liabilities + Equity.

Every transaction in this system will affect at least two accounts if not more. A transaction is recorded in terms of left and right. Understanding the fact that a debit is on the left side and credit on the right side is crucial to your success in the field of accounting.

This chart will help in remembering how debits and credits work in different accounts. There are five major accounts that make up a facility’s chart of accounts as well as many subaccounts that fall under each category. The five major accounts are Assets, Liabilities, Equity, Revenue, and Expenses.

Assets

Assets are the items a company owns to be used for future benefits. Here are some common examples of assets:

- Cash

- Accounts receivable

- Prepaid Expenses

- Land

- Building

- Vehicles

Liability

Liability is the creditor claim on the company’s assets or the amount of money owed to other companies or vendors. Here are some examples of the most common liabilities:

- Accounts payable

- Bank loans

- Line of Credit

- Unearned Income

Equity

Equity represents the rights, or the claims of the owner/s. Equity represents the residual claim on assets of the company. Here are some equity examples:

- Capital

- Withdrawal

Revenue

Revenue is the money generated from normal business activities of the company. Here are some common examples of revenue:

- Rent (Assited Living, Independent Living, MCU)

- Personal Care

- Medical Management

- Housekeeping Services

- Dining Services

- Transportation Services

- Community Fees

Expenses

Expenses are the cost incurred by the company to generate revenue. Here are some common expenses for a company:

- Salaries and Wages

- Utilities

- Insurance

- Real Estate Taxes

- Employee Recruiting

- Food Supply

- Vehicle Repair

- Travel and Entertainment

- Employees Mileage

Leave a Reply